Each CEO faced scrutiny over slightly different matters, but they generally projected the same idea: their successes are simply the result of their own ingenuity, and not due any monopolistic power-plays despite the mounting evidence.

Apple is the antitrust crew’s best performing tech giant

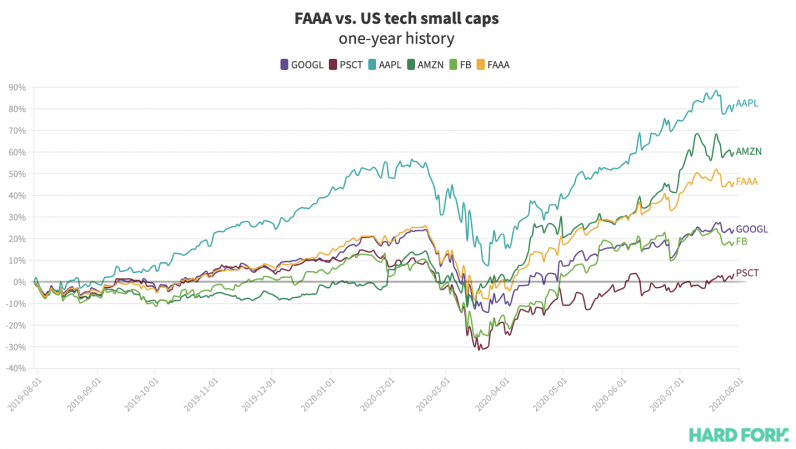

But the divide between the US tech giants and smaller firms is severe since the enormous stock market crash that occurred in March. PSCT follows 74 companies valued between $300 million and $1.4 billion, and serves as a benchmark for the smaller (but investable) fish in US tech. First, note how well Apple stock has performed, both pre- and post-COVID crash. $AAPL is up more than 80% since this time last year despite the market turmoil. This added nearly $694 billion to its market value, solidifying the iPhone maker’s position as the most valuable US company, tech or otherwise. Overall, the data shows US tech small caps have recovered far slower than FAAA, which is up 46% since this time last year. The difference is most apparent when comparing FAAA’s market performance against their small cap counterparts over the year-to-date. [Read: Anatomy of the FANTAMAN, the tech stock amalgam worth more than Germany’s GDP] As for what will alleviate FAAA’s apparent control over the market, House Antitrust Committee Chairman David Cicilline maintained that tech giants present a modern problem that requires specialized regulation. “Some need to be broken up, all need to be properly regulated and held accountable. We need to ensure the antitrust laws first written more than a century ago work in the digital age,” concluded Cicilline.