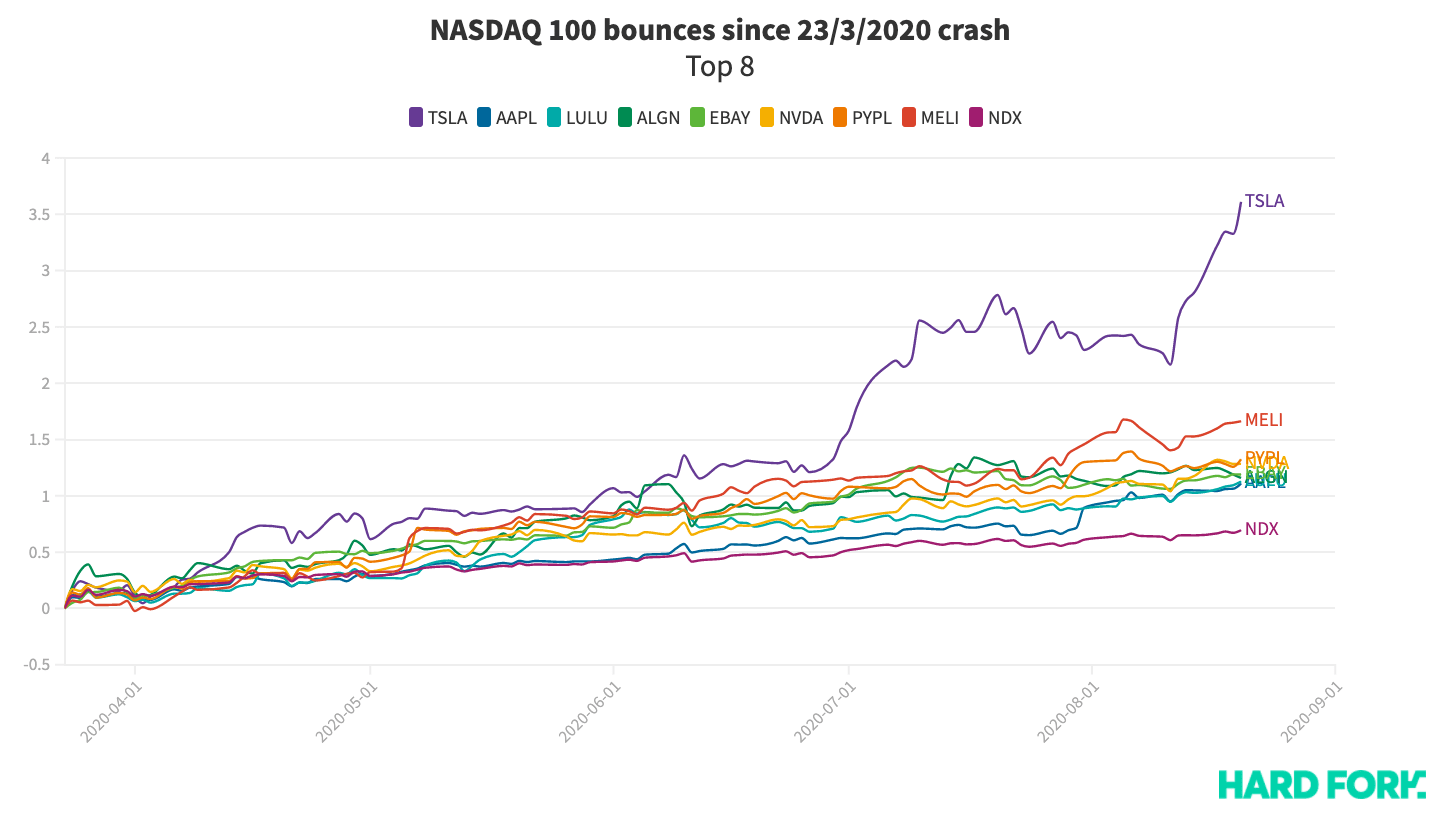

Still, even after removing Tesla as an outlier, a dozen companies in the tech-heavy NASDAQ 100 (NDX) have seen their share prices more than double since the index’s 2020 low on March 23. [Read: Tesla and Apple set stock splits to lower share prices — then they rallied] That list includes the “Argentinian Alibaba” Mercadolibre, up an eye-twitching 166% since the NDX’s COVID crash, and fintech giant PayPal, which has bounced from $85.26 all the way to $198.18 in just five months. Not quite as big as Tesla’s 360% recovery, but still remarkable.

Chipset prince NVIDIA, online market lord eBay, orthodontic play Align Technology, and activewear incumbent Lululemon all staged remarkable comebacks too, up 128%, 118%, 115%, and 112% respectively. The only plausible explanation for the latter pair being the importance of looking good for Insta during lockdown. As it turns out, they all bounced harder than Apple. The maker of the iPhone has only managed a disrespectful 111% since NDX’s lowest point this year, but nonetheless contributed to sending the NDX to record highs this year, despite… global chaos. But in terms of market values, no NDX company has added more dollars to their capitalizations than the Cupertino giant. Apple was worth $959 million on March 23, and now it’s worth more than $2 trillion — the largest company in the US, tech or otherwise. This means Apple’s COVID-19 bounce is now valued in excess of $1 trillion. [Read: Watch Apple’s market cap hit $2 trillion in this NASDAQ bar chart race] But again, it’s Tesla that stands out. The visualization above shows the value added to each NDX constituent since March 23 — the bigger the bubble, the more value added since the bottom. Check out Elon Musk’s electric vehicle wunderstock: Tesla added $169.5 billion to its market value post-COVID, and sits prominently amongst Alphabet, Facebook, NetEase, NVIDIA, and PayPal. (NB: If the visualization doesn’t show, try reloading this page in your browser’s “Desktop Mode.”) Hard Fork found just two NDX companies yet to recover from March 23’s COVID crash: pharma stocks Gilead and Walgreen Boots Alliance, respectively down 4% and 8% since their individual lows on that day. In any case, the NDX overall is up 30% for the year. What’s the opposite of a dead cat bounce?